To receive an exemplary score on the Supply and Demand section of your paper, you’ll need to do the following:

-Effectively evaluate trends in demand over time

-Explain the impact the demand trends have on the industry and the firm in detail

-Analyze information and data related to the demand and supply for the firm’s product(s)

-Use the information and data on supply and demand to support a recommendation (or recommendations) for the firm’s actions (noted in bold text in example below)

-Include a graphical representation of data and information (using the last 5 years of company sales data is a great choice, as shown in example below)

-Use concrete examples in your analysis (in the example below you’ll notice a discussion of demand in China and of the supply of cocoa)

Here is an example that meets the above requirements:

Supply and Demand

With the demand for chocolate rising and its growing popularity in the international markets, it’s important that we analyze and understand the supply and demand trends to determine how Hershey can best align its firm’s product to sustain future growth in the confectionery market. In addition, we need to evaluate pricing along with revenue growth to understand the impact it will have on consumer responsiveness by utilizing the price of elasticity of demand as our guide. As noted in my initial introduction, the demand for chocolate in the global market is expected to have an annual rate increase of about 3 percent with “Asia being the major source in growth sales, and is expected to rise to a 20 percent share in the global market by 2016” (Bradford, n.d.).

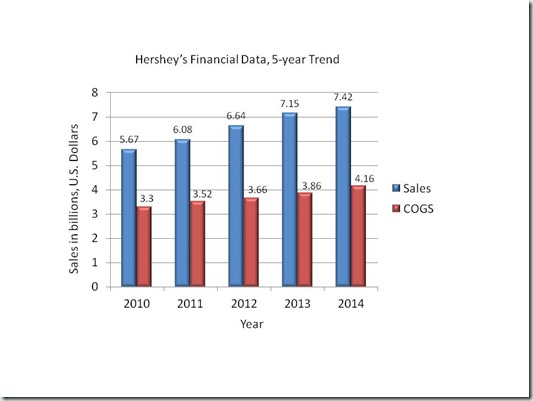

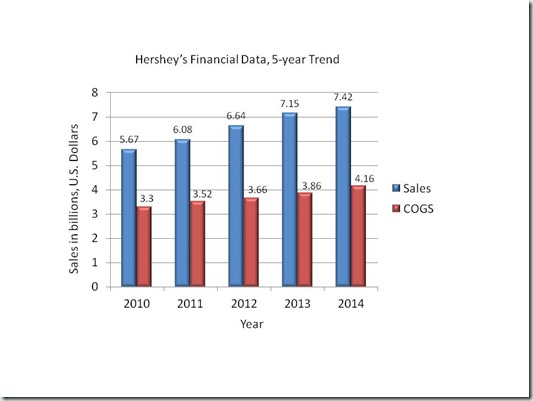

As illustrated in the graph below, Hershey has shown tremendous growth in sales over the last 5-years and contributes much of its growth from “a nearly 10% price increase that was phased in over the last couple of years” (Wismer, 2013).

Figure 1. Hershey’s Revenue and Cost of Goods Sold (COGS incl. D&A) data for the past 5-years. Adapted from HSY Annual Income Statement - Hershey Co. Annual Financials. (n.d.). Retrieved from http://www.marketwatch.com/investing/stock/hsy/financials

The company also had a strong, aggressive business strategy that included special promotions, brand extensions, new products, and acquisitions of candy makers that offered diversity in product textures and unique flavors. With a solid rank in the U.S. market, the company is now positioned to expand its operation into key international markets to improve global sales (Wismer, 2013).

In 2013, the company expanded into China and acquired 80% of renowned candy maker, Shanghai Golden Monkey. The established company is recognized in its home market with supported net sales growth in the double-digits making it the ideal partnership for Hershey to expand its footprint and gain access to an emerging demographic market (Merced, 2013). The acquisition resulted in a good deal with Hershey growing its sales to $7.4 billion in 2014, and China being responsible for 4.5 percent of those earnings. According to Reuters (2015), “the chocolate consumption growth in the emerging markets closely tracks GDP growth, suggesting China’s increasing urban population would drive chocolate consumption”. Based on these facts, the rising demand for chocolate by the urban population in China is expected to grow to $4.3 billion by 2019. That would be almost a sixty percent increase from the $2.7 billion sales in 2014 (Reuters, 2015). Given the surging demand for chocolate in China, I recommend that Hershey continue to invest resources into expanding their operations to grow their sales in China.

As the popularity for the taste of chocolate grows so does the increased demand for cocoa, which is the main ingredient needed to make chocolate. There are many factors that influence the price of cocoa with the most serious being lack of resources and monetary earnings by the “small-scale family farmers who grow 90% of the worlds cocoa” (Goodyear, n.d.). This has resulted in low production with many farmers leaving the industry due to low wages and poverty in their community. The “demand for cocoa is predicted to rise by 30% by 2020 but without investing in small-scale farmers, the industry will struggle to provide sufficient supply” (Goodyear, n.d.). My recommendation would be for Hershey to support and invest in Fairtrade certified cocoa organizations, which encourage long-term business relationships with cocoa farmers by ensuring higher wages and proper resources to produce long-term quality products. By aligning and buying their supplies from Fairtrade certified farmers, the company would be strengthening their business relationship and investing in the most crucial ingredient for the company’s products, cocoa. Without this ingredient, the company would no longer have a functioning chocolate confectionery business.

References

Bradford, C. (n.d.). How Large Is the Chocolate Industry? | Chron.com. Retrieved from http://smallbusiness.chron.com/large-chocolate-industry-55639.html

HSY Annual Income Statement - Hershey Co. Annual Financials. (n.d.). Retrieved from http://www.marketwatch.com/investing/stock/hsy/financials

Wismer, D. (2013, February 12). Hershey's: 'One Of The Sweetest Stocks On Earth' This Valentine's Day? - Forbes. Retrieved from http://www.forbes.com/sites/davidwismer/2013/02/12/hersheys-hsy-one-of-the-sweetest-stocks-on-earth-this-valentines-day/

Goodyear, D. (n.d.). The future of chocolate: why cocoa production is at risk | Sustainable Business - Fairtrade partner zone | The Guardian. Retrieved from http://www.theguardian.com/sustainable-business/fairtrade-partner-zone/chocolate-cocoa-production-risk

-Effectively evaluate trends in demand over time

-Explain the impact the demand trends have on the industry and the firm in detail

-Analyze information and data related to the demand and supply for the firm’s product(s)

-Use the information and data on supply and demand to support a recommendation (or recommendations) for the firm’s actions (noted in bold text in example below)

-Include a graphical representation of data and information (using the last 5 years of company sales data is a great choice, as shown in example below)

-Use concrete examples in your analysis (in the example below you’ll notice a discussion of demand in China and of the supply of cocoa)

Here is an example that meets the above requirements:

Supply and Demand

With the demand for chocolate rising and its growing popularity in the international markets, it’s important that we analyze and understand the supply and demand trends to determine how Hershey can best align its firm’s product to sustain future growth in the confectionery market. In addition, we need to evaluate pricing along with revenue growth to understand the impact it will have on consumer responsiveness by utilizing the price of elasticity of demand as our guide. As noted in my initial introduction, the demand for chocolate in the global market is expected to have an annual rate increase of about 3 percent with “Asia being the major source in growth sales, and is expected to rise to a 20 percent share in the global market by 2016” (Bradford, n.d.).

As illustrated in the graph below, Hershey has shown tremendous growth in sales over the last 5-years and contributes much of its growth from “a nearly 10% price increase that was phased in over the last couple of years” (Wismer, 2013).

Figure 1. Hershey’s Revenue and Cost of Goods Sold (COGS incl. D&A) data for the past 5-years. Adapted from HSY Annual Income Statement - Hershey Co. Annual Financials. (n.d.). Retrieved from http://www.marketwatch.com/investing/stock/hsy/financials

The company also had a strong, aggressive business strategy that included special promotions, brand extensions, new products, and acquisitions of candy makers that offered diversity in product textures and unique flavors. With a solid rank in the U.S. market, the company is now positioned to expand its operation into key international markets to improve global sales (Wismer, 2013).

In 2013, the company expanded into China and acquired 80% of renowned candy maker, Shanghai Golden Monkey. The established company is recognized in its home market with supported net sales growth in the double-digits making it the ideal partnership for Hershey to expand its footprint and gain access to an emerging demographic market (Merced, 2013). The acquisition resulted in a good deal with Hershey growing its sales to $7.4 billion in 2014, and China being responsible for 4.5 percent of those earnings. According to Reuters (2015), “the chocolate consumption growth in the emerging markets closely tracks GDP growth, suggesting China’s increasing urban population would drive chocolate consumption”. Based on these facts, the rising demand for chocolate by the urban population in China is expected to grow to $4.3 billion by 2019. That would be almost a sixty percent increase from the $2.7 billion sales in 2014 (Reuters, 2015). Given the surging demand for chocolate in China, I recommend that Hershey continue to invest resources into expanding their operations to grow their sales in China.

As the popularity for the taste of chocolate grows so does the increased demand for cocoa, which is the main ingredient needed to make chocolate. There are many factors that influence the price of cocoa with the most serious being lack of resources and monetary earnings by the “small-scale family farmers who grow 90% of the worlds cocoa” (Goodyear, n.d.). This has resulted in low production with many farmers leaving the industry due to low wages and poverty in their community. The “demand for cocoa is predicted to rise by 30% by 2020 but without investing in small-scale farmers, the industry will struggle to provide sufficient supply” (Goodyear, n.d.). My recommendation would be for Hershey to support and invest in Fairtrade certified cocoa organizations, which encourage long-term business relationships with cocoa farmers by ensuring higher wages and proper resources to produce long-term quality products. By aligning and buying their supplies from Fairtrade certified farmers, the company would be strengthening their business relationship and investing in the most crucial ingredient for the company’s products, cocoa. Without this ingredient, the company would no longer have a functioning chocolate confectionery business.

References

Bradford, C. (n.d.). How Large Is the Chocolate Industry? | Chron.com. Retrieved from http://smallbusiness.chron.com/large-chocolate-industry-55639.html

HSY Annual Income Statement - Hershey Co. Annual Financials. (n.d.). Retrieved from http://www.marketwatch.com/investing/stock/hsy/financials

Wismer, D. (2013, February 12). Hershey's: 'One Of The Sweetest Stocks On Earth' This Valentine's Day? - Forbes. Retrieved from http://www.forbes.com/sites/davidwismer/2013/02/12/hersheys-hsy-one-of-the-sweetest-stocks-on-earth-this-valentines-day/

Goodyear, D. (n.d.). The future of chocolate: why cocoa production is at risk | Sustainable Business - Fairtrade partner zone | The Guardian. Retrieved from http://www.theguardian.com/sustainable-business/fairtrade-partner-zone/chocolate-cocoa-production-risk

Comments

Post a Comment