Target (Example)

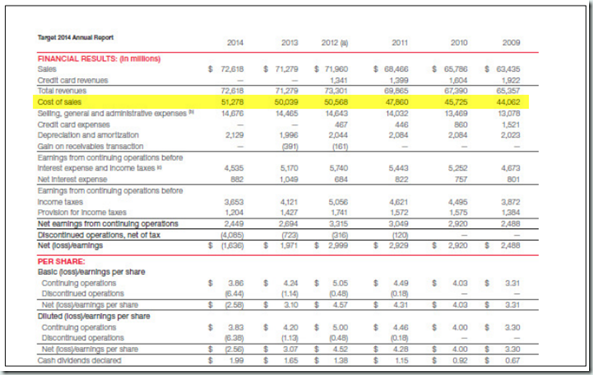

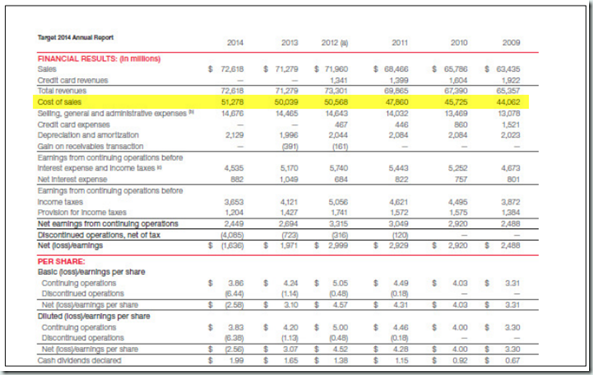

• For finding Revenue you should find the Income Statement for your firm. The Income Statement (example below) is where you will find Revenues (needed for Milestone Two), Costs (needed for Milestone Three), and Net Earnings (or “Profit”). The first line will show you the revenue (or sales) and the line immediately below the total sales will show you the Costs of Goods Sold (COGS). Sometimes this is also called Cost of Revenue or Cost of Sales. These are the VARIABLE COSTS that your firms face, which is important in Milestone 3! Right beneath your variable costs you should see Selling General and Administrative expenses (SG&A), which are your FIXED COSTS. There is another post that explains why fixed and variable costs differ, but for now I want to focus on where you will see these costs on your Income Statement.

• Notice for Total Revenues it shows from 2009 to 2014. If there isn’t a chart provided in the income statement that shows that trend you’ll need to create your graph or use the Excel Supply and Demand chart that I have provided for you in the General Questions Discussion Board on Brightspace. Once you have your chart, the most important thing that you MUST do is write about what the numbers show. Are Revenues increasing or decreasing? Why? Are there any reasons? Business expansion? Closed stores?

• I left the Per Share (stock information) to show you that is many times listed but really is irrelevant to the paper. Why? Because stock values increasing or decreasing doesn’t really help for the paper. That is investor information but is not necessarily telling your reader whether the company revenue and/or costs are increasing or decreasing. That stock move COULD be simply because what ANOTHER competitor did and not related to something the company did. If you are writing about per share or other stock information when you are talking about demand conditions you are on the wrong track!! Please stop and delete what you have just written.

• You will have to find other sources too regarding specific topics but a lot of the information required for your paper should be available in the Annual Report alone!

• Also be looking for other relevant information in the Annual Report that might help you as well. Many firms will provide a “Financial Highlights” section and that can also give you images or information you might find useful. Glance through the Annual Report and there is usually great information that will help you provide some additional detail for Milestone Two, Milestone Three, and the Final Paper regarding their competition, market share, and future plans. Glancing through your Annual Report you will find incredible amounts of information you will find helpful! Just make sure you explain the information you find in your paper (don’t just copy charts without providing any commentary).

• For finding Revenue you should find the Income Statement for your firm. The Income Statement (example below) is where you will find Revenues (needed for Milestone Two), Costs (needed for Milestone Three), and Net Earnings (or “Profit”). The first line will show you the revenue (or sales) and the line immediately below the total sales will show you the Costs of Goods Sold (COGS). Sometimes this is also called Cost of Revenue or Cost of Sales. These are the VARIABLE COSTS that your firms face, which is important in Milestone 3! Right beneath your variable costs you should see Selling General and Administrative expenses (SG&A), which are your FIXED COSTS. There is another post that explains why fixed and variable costs differ, but for now I want to focus on where you will see these costs on your Income Statement.

• Notice for Total Revenues it shows from 2009 to 2014. If there isn’t a chart provided in the income statement that shows that trend you’ll need to create your graph or use the Excel Supply and Demand chart that I have provided for you in the General Questions Discussion Board on Brightspace. Once you have your chart, the most important thing that you MUST do is write about what the numbers show. Are Revenues increasing or decreasing? Why? Are there any reasons? Business expansion? Closed stores?

• I left the Per Share (stock information) to show you that is many times listed but really is irrelevant to the paper. Why? Because stock values increasing or decreasing doesn’t really help for the paper. That is investor information but is not necessarily telling your reader whether the company revenue and/or costs are increasing or decreasing. That stock move COULD be simply because what ANOTHER competitor did and not related to something the company did. If you are writing about per share or other stock information when you are talking about demand conditions you are on the wrong track!! Please stop and delete what you have just written.

• You will have to find other sources too regarding specific topics but a lot of the information required for your paper should be available in the Annual Report alone!

• Also be looking for other relevant information in the Annual Report that might help you as well. Many firms will provide a “Financial Highlights” section and that can also give you images or information you might find useful. Glance through the Annual Report and there is usually great information that will help you provide some additional detail for Milestone Two, Milestone Three, and the Final Paper regarding their competition, market share, and future plans. Glancing through your Annual Report you will find incredible amounts of information you will find helpful! Just make sure you explain the information you find in your paper (don’t just copy charts without providing any commentary).

Comments

Post a Comment